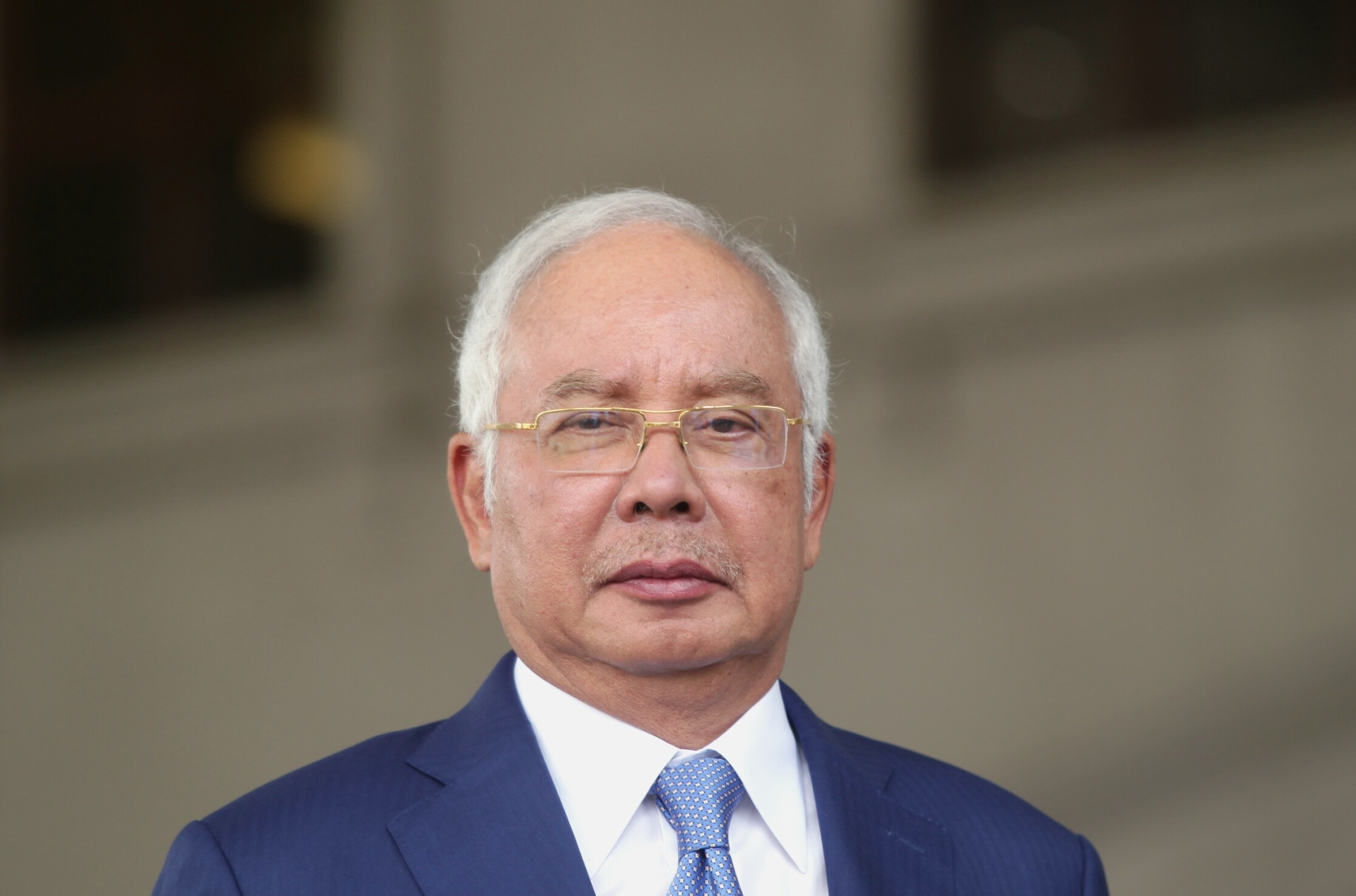

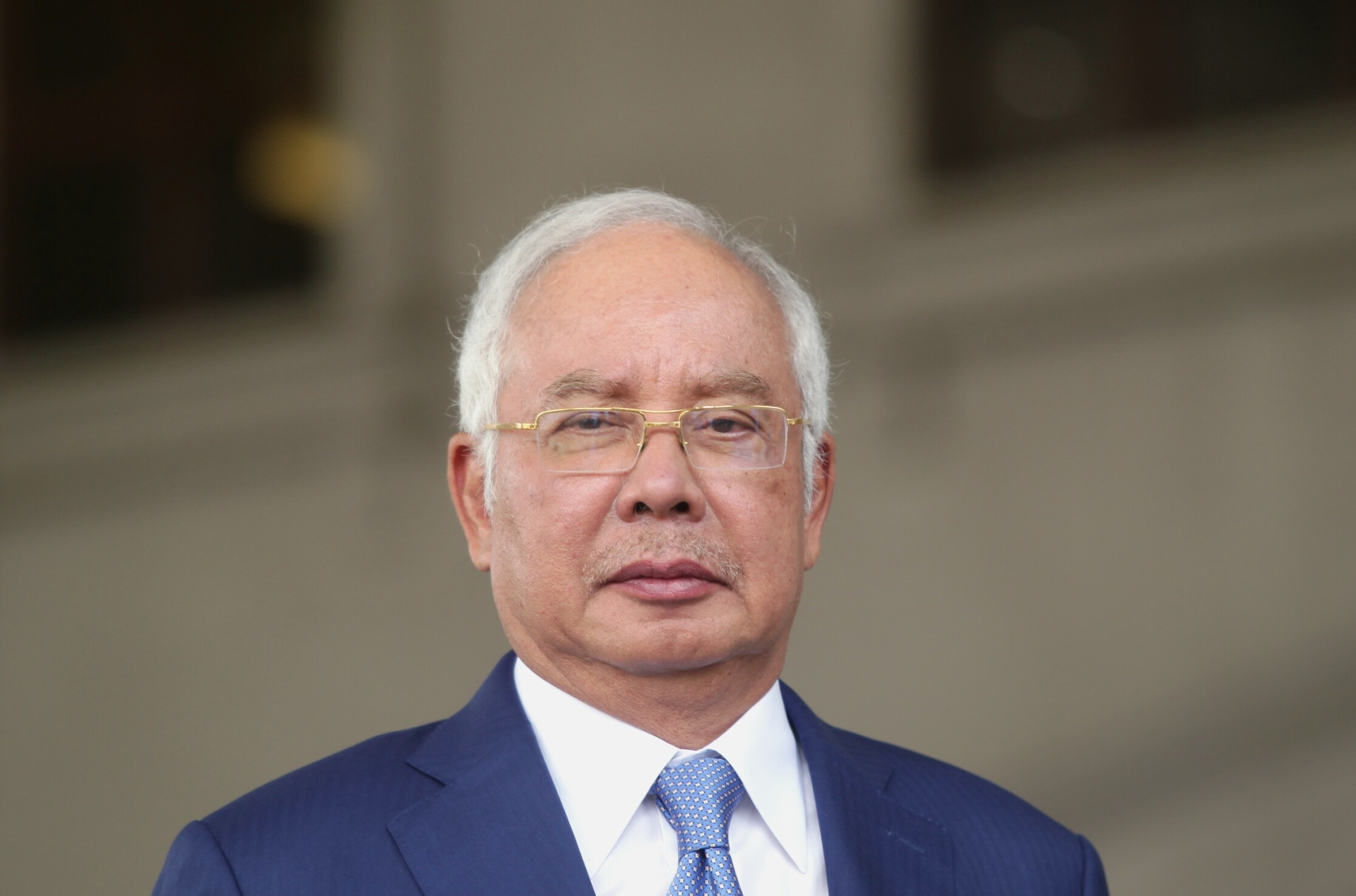

IRB’s deputy revenue solicitor Abu Tariq Jamaluddin said it was unfair to other taxpayers if Najib, who was named as the defendant in the suit, was exempted to do so.

He submitted that the IRB had issued the notice to the defendant asking him to pay the amount.

“However, there was no request from the defendant for an arrangement of the payment and therefore, we filed the suit to recover the money.

“If there was no payment, the suit will be filed. It applies to all taxpayers,” he said in his submissions in IRB’s application for summary judgment against Najib over payment of RM1.69 billion in income tax.

Summary judgment is where a court decides a case without hearing the testimony of witnesses.

Abu Tariq further said the court should have allowed the application as provided under Section 106 (3) of the Income Tax Act 1967 (Act 53).

The section reads: “In any proceedings under this section, the court shall not entertain any plea that the amount of tax sought to be recovered is excessive, incorrectly assessed, under appeal or incorrectly increased.”

Najib’s counsel Tan Sri Muhammad Shafee Abdullah countered that there were no special circumstances for the court to grant the IRB’s application for summary judgment through Order 14 of the Rules of Court 2012.

“The plaintiff (IRB) is depriving the court of looking at the merits of the case when they applied for summary judgment.

“They sued us, but we cannot fight the case (through a trial). Isn’t this an intrusion to the judiciary power that the court cannot do anything?,” he said adding that the Order 14 is a draconian law and Section 106 (3) raised a monster out of the law.

The lawyer also questioned why the IRB was in a hurry to seek the summary judgment against his client saying that it amounted to being oppressive against Najib.

“If Your Honour allowed the application, they (IRB) can oppressively move to get the RM1.69 billion taxes against my client, whereas my client doesn’t owe even a single cents from them (IRB), “ he said.

Justice Datuk Ahmad Bache said he needed a month to decide the matter.

“I will inform the parties a week before the date of the decision,” he said.

The court had on Feb 28 dismissed Najib’s application for a stay of proceedings of the IRB’s suit seeking him to pay RM1.69 billion in income tax pending an appeal on the tax assessment to IRB.

On Aug 8, last year, Najib filed an application for a stay of proceedings of the IRB’s suit.

However, the IRB, in its supporting affidavit, said that the former prime minister still had to pay the total amount of RM1.69 billion even if he had filed an appeal against the tax assessment.

IRB Monitoring Unit assistant director Hisyamuddin Mohd Hassan, in his supporting affidavit, said that according to Section 103 of the Income Tax Act 1967, all the assessed tax shall be due and payable on the day the notice of assessment is served, whether or not the person appeals against the assessment.

On June 25, last year, the government through the IRB filed the suit against the Pekan MP, seeking him to pay RM1.69 billion in unpaid tax with interest at five per cent a year from the date of judgment, as well as costs and other relief deemed fit by the court.

— BERNAMA