KUALA LUMPUR: Retirement Fund Incorporated (KWAP) former chief executive officer (CEO) Datuk Azian Mohd Noh said the RM4 billion loan to SRC International Sdn Bhd was among the highest approved by the statutory body.

KUALA LUMPUR: Retirement Fund Incorporated (KWAP) former chief executive officer (CEO) Datuk Azian Mohd Noh said the RM4 billion loan to SRC International Sdn Bhd was among the highest approved by the statutory body.

Continuing his testimony today, he told the High Court here that he was appointed as KWAP’s first CEO and an ex-officio member of its board of directors in March 2007 and retired on March 17, 2013.

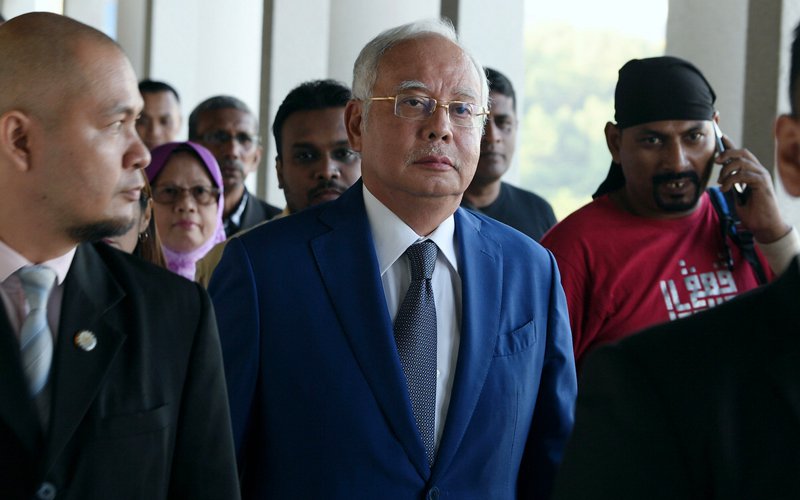

“Based on my experience while serving in KWAP, the two loans to SRC totalling RM4 billion were among the highest amounts ever approved by KWAP,” he said on the 20th day of Datuk Seri Najib Tun Razak’s trial.

The former prime minister is facing seven charges of misappropriating SRC International Sdn Bhd funds totalling RM42 million.

The 38th prosecution witness said KWAP approved the first loan of RM2 billion to SRC International Sdn Bhd in 2011 and the second loan of RM2 billion the following year (2012).

Azian, 66, who is a member of Danajamin Nasional Berhad board of directors said KWAP also received from the Finance Ministry, a letter dated March 28, 2012 agreeing to furnish a 10-year guarantee for the second RM2 billion loan to SRC International Sdn Bhd, pursuant to a Cabinet endorsement on Feb 8, 2012.

“The letter sought the KWAP’s consideration for the sum to be released in advance, with the ministry pledging to submit the government guarantee within 10 days,” Azian said during the examination-in-chief by deputy public prosecutor Datuk Ishak Mohd Yusoff.

On whether KWAP had ever released any loan before getting a guarantee letter, the witness said such situation never happened.

He also confirmed that there was a letter from the finance ministry dated May 18, 2012 to change the purpose of the loan given to SRC.

“The letter stated that the loan was for investment activities in natural resources and revolving fund only and not for general investment. The letter was also based on the Cabinet’s decision on Feb 8, 2012,” he said.

He said using the loan from KWAP for purposes other than investment in natural resources and revolving fund would be a breach of the terms of the agreement and constituted an event of default.

-BERNAMA